Your friend has referred you to ING, the bank that Canstar has awarded Bank of the Year 2023 for the fourth year in a row.

Bank a $100 bonus on us

You could unlock a number of benefits by opening a transaction and savings account with ING. Like 1% cash back on utility bills, rebates on international transaction fees and up to a % variable interest rate for eligible customers.

Plus, for a limited time you and the friend who referred you could receive a $100 bonus... each! All you need to do is complete the 4 steps below by 30 June 2024.

Just complete these steps by 30 June 2024

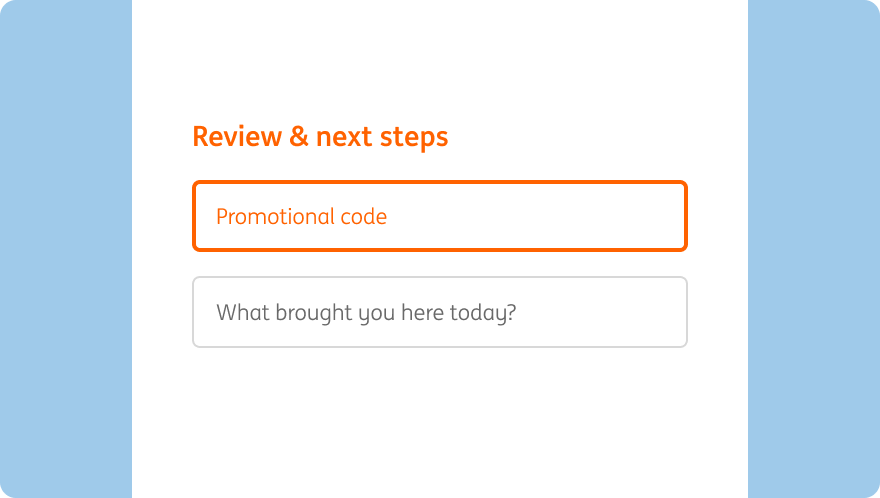

Open an Orange Everyday by clicking open now below and enter the promo code from your friend in the box at the end of the online form.

Open nowDeposit $1,000+ from an external source into your new Orange Everyday account within any calendar month.

Make 5+ settled (not pending) purchases using your new Orange Everyday card within any calendar month.

Open a Savings Maximiser (if you don't have one already) then make a deposit of any amount into it.

Just click yes to adding a Savings Maximiser in the online application.

Open now

Where to enter the promo code

To be eligible to earn your $100 bonus you must enter the promo code ASK YOUR FRIEND. Simply pop it in the box at the end of the online application form. It's the last step right before you click submit.

Payday's not too far away

Once all steps are completed we'll pop a $100 bonus into both your Orange Everyday account and the Orange Everyday account of the friend who referred you to ING. This could take up to 30 days after you have met all the requirements and in some cases this may take longer. Once in your account you can spend or save however you like. Maybe some new shoes or karate lessons... if that's your thing? Think of it as our way of saying welcome to ING, it's great to have you on board.

Open nowGet your bonus working harder with Savings Maximiser

Once you have an Orange Everyday and Savings Maximiser, you can also start earning our highest available variable rate whenever you meet the monthly criteria.

Earn up to

% p.a.

Variable rate

Includes % p.a. additional variable rate. The standard variable rate is % p.a.

On one account, up to $100,000 when you also hold an Orange Everyday and each month meet the eligibility criteria - see T&Cs for full details.

Open nowAny questions

For more about our everyday and savings accounts, simply visit Orange Everyday and Savings Maximiser.