Get your hands on something super

Open Living Super

Grow your retirement pot

with Living Super

With low fees1 plus the convenience of seeing your super and banking together in one place, Living Super gives you the tools to grow the pot at the end of your retirement rainbow. If you'd like to understand more, please keep reading!

Low fees1

Annual fees and costs on a $50,000 balance invested in Living Super's diversified managed investment options have lower fees than the industry average1. For example, the High Growth investment option has annual fees and costs of $390.

Committed to keeping costs down

With Living Super, you enjoy low fees1, which means more money stays in your super to work harder for you.

Did you know Living Super fees have come down recently?

Along with other changes to fees and investment options, on 1 December 2023, the variable component of the administration fee was reduced from 0.50% per annum to 0.35% per annum. For an example $50,000 account balance invested in Living Super's High Growth investment option annual fees dropped by more than 10%, from $440 to $390 per annum.

Compare Living Super with your current fund

It's easy to compare fees between super funds. Your current fund will publish a PDS showing the fees for a $50,000 balance, and you need to check you're comparing with a comparable investment option, and the wider services provided. You might be surprised how much you're paying.

Click here to learn more about fees and go to 'Rates and fees' page

Learn more about feesOne place for your super and banking

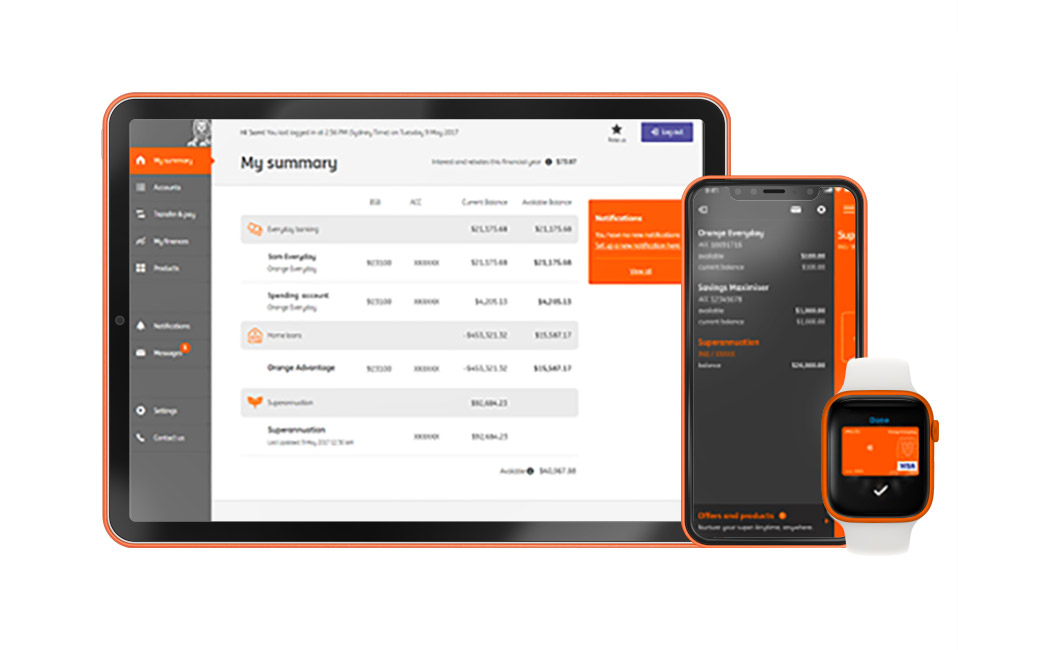

You can view your balance and make most investment transactions on your tablet or desktop.

See your super with your banking

You can view your Living Super account together with your other ING accounts using your phone, tablet or desktop anytime.

Flexibility at your fingertips

Whether you're keeping it simple with a diversified option or more hands on with a customised trading portfolio, you can easily change investments according to your comfort level, simply by logging into ing.com.au on your desktop or tablet.

Investment performance2

Did you know our High Growth investment option has delivered a return of 10.47% p.a. since launching in 2012?

Super is a long-term investment. The High Growth investment option is suitable for those with a ten-year time horizon or more, and who can tolerate a high level of risk over the long term. Other diversified managed investment options are referenced below.

Living Super offers a range of other managed investment options and ASX Listed Securities for those with different investment objectives and risk profiles. Please read the PDS and Product Guide for more information.

You should also note that past performance is not an indicator of future performance - investments can go up and down.

Investment performanceSet up your new super account in 3 simple steps

Get going online in just 3 steps.

Open your account

To get set up just enter your contact details, your tax file number and select from one or more of the Living Super investment options - about 5 minutes.

Consolidate your super

Find your other super so you stop paying for multiple things that could be eating into your savings, like duplicate fees or insurance you may not need.

Tell your employer

Once open, you'll be sent a short form to give to your employer to ensure your super goes straight into your new Living Super account.

Before consolidating your super accounts, you should consider where future employer contributions will be paid, any fees you may incur with the rollover and lost current insurance benefits, and other features of your existing provider(s). You should discuss any potential super strategies with your accountant or financial adviser.

You should read the Product Disclosure Statement, Product Guide, FSG and Target Market Determination available at ing.com.au/documents and the product's appropriateness when deciding whether to acquire, or to continue to hold, the product.

When choosing your investment within Living Super, you should consider the likely investment return, risk and how long you will be investing your super and remember that past performance is not a reliable indicator of future performance.

Sign up in minutesQuestions? Call 133 464

When opening your account online, remember:

For more information about Living Super refer to:

Here to help

Questions? Call 133 464