For whatever's on the cards.

Low interest rate 12.99% p.a. variable on purchases.

No ING International Transaction Fees.

Complimentary international travel insurance. T&C apply.

Which one is right for you?

Want a credit card with a low rate? Take a look at Orange One Low Rate. Like the sound of cashback on your spend? Check our Orange One Rewards Platinum.

Either way you'll pay no ING international transaction fees when you shop overseas or online.

Spend smarter, with a low interest rate and no ING International Transaction Fees when shopping online or overseas.

Low interest rate

12.99% p.a. variable on purchases.

No ING international transaction fees

$0 ING international transaction fees when you shop online and overseas.

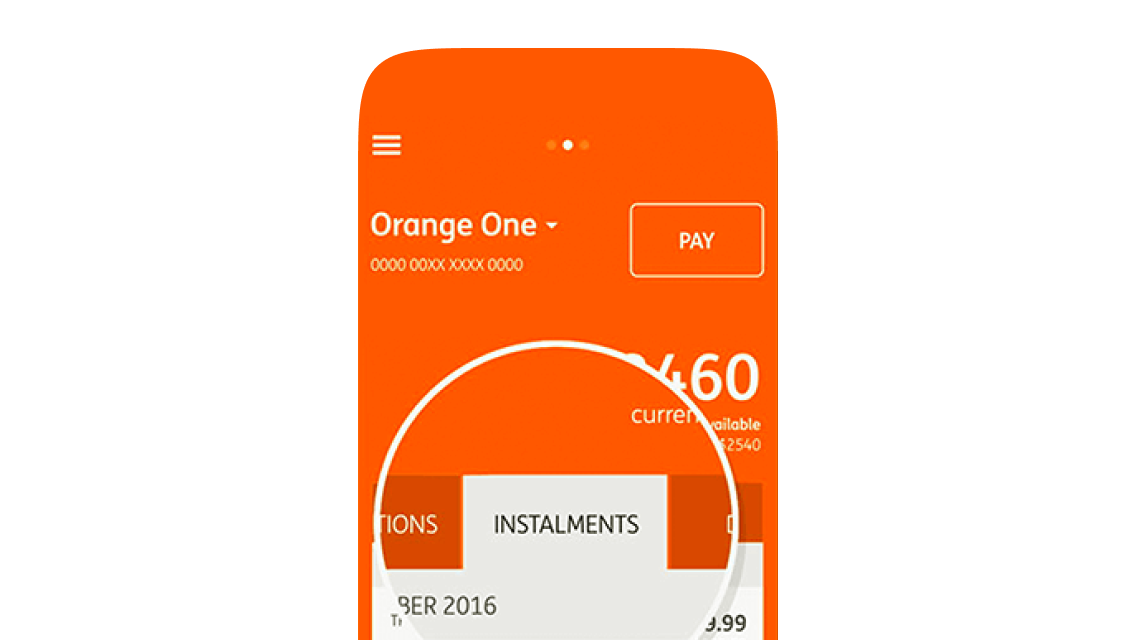

Instalment plans

Use instalment plans to pay off your purchases over time at a lower interest rate of 9.99% p.a. variable.

Complimentary international travel insurance

When you are approved for a credit limit of $6,000 or more. Eligibility and conditions apply to cover.

Setup notifications

Setup notifications to manage your spending limits.

Automatic repayments

Automatic repayments from eligible ING accounts.

Get up to $30 a month cashback on your spend per account, and no ING International Transaction Fees when you shop overseas or online.

1% cashback

1% cashback on your eligible spend, up to $30 a month per account. Conditions apply.

No ING international transaction fees

$0 ING international transaction fees when you shop online and overseas.

Complimentary international travel insurance

Complimentary international travel insurance. Conditions apply.

Instalment plans

Use instalment plans to pay off your purchases over time at a lower interest rate of 9.99% p.a. variable.

Setup notifications

Setup notifications to manage your spending limits.

Automatic repayments

Automatic repayments from eligible ING accounts.

Compare our credit cards

Which one is right for you?

Orange One Low Rate Low rate credit card. |

Orange One Rewards Platinum Platinum credit card with cashback rewards. |

|---|---|

|

Cashback rewards on your spend (up to $30 a month) | |

|

Complimentary international travel insurance | |

| (When you are approved for a credit limit of $6,000 or more. Eligibility and conditions apply to cover.) | |

|

Manage your purchases using instalments | |

|

Automatic repayments from eligible ING accounts | |

|

Mobile payments with Apply Pay and Google Pay | |

|

Setup notifications to manage your spending limits | |

Orange One Low Rate Low rate credit card. |

Orange One Rewards Platinum Platinum credit card with cashback rewards. |

|---|---|

|

Interest rates | |

|

Purchases 12.99% p.a. variable Instalments 9.99% p.a. variable Cash advances 12.99% p.a. variable |

Purchases 16.99% p.a. variable Instalments 9.99% p.a. variable Cash advances 16.99% p.a. variable |

|

Interest free period | |

|

Up to 45 days interest free |

Up to 45 days interest free |

|

Annual Fee | |

|

$48 |

$149 |

|

Late payment fee | |

|

$30 |

$30 |

|

Over limit fee | |

|

$0 |

$0 |

|

Additional cardholder | |

|

$10/year per additional card |

$10/year per additional card |

|

Dishonours | |

|

$0 |

$0 |

|

Replacement card (in Australia or overseas) | |

|

$0 |

$0 |

|

Emergency replacement card | |

|

$0 |

$0 |

|

Voucher request | |

|

$10 |

$10 |

|

Cash advance fee | |

|

The greater of $3 or 3% of the cash advance amount. |

The greater of $3 or 3% of the cash advance amount. |

Orange One Low Rate Low rate credit card. |

Orange One Rewards Platinum Platinum credit card with cashback rewards. |

|---|---|

|

Minimum credit limit | |

|

$1,000 |

$6,000 |

|

Maximum credit limit | |

|

$30,000 |

$30,000 |

|

Cash advances | |

|

10% of the credit limit, up to a $500 maximum |

10% of the credit limit, up to a $500 maximum |

|

Purchases using Visa payWave without a PIN | |

|

Under $100 in Australia (other limits may apply outside of Australia) |

Under $100 in Australia (other limits may apply outside of Australia) |

Orange One Low Rate Low rate credit card. |

Orange One Rewards Platinum Platinum credit card with cashback rewards. |

|---|---|

|

To be eligible to apply, you must | |

|

Note: Orange One Low Rate is currently not available to Self-employed applicants. |

Note: Orange One Rewards Platinum is currently not available to Self-employed applicants. |

When you need us

For questions or anything else, we're here to help.

Here for you

ing.com.au/contactus