You've been referred!

Open a transaction and savings account with ING and you could earn a bonus, plus more!

Terms and conditions apply$0 ongoing account fees

1% cashback on eligible utility bills

Earn up to % p.a. variable rate

Bank a bonus on us + a great rate

You could unlock a number of benefits by opening a transaction and savings account with ING including % p.a variable interest rate for eligible customers.

Plus, for a limited time you and the friend who referred you could receive a bonus... each! All you need to do is complete the 4 steps below by 31 March 2026.

Here's what you need to do

To earn that sweet bonus for both you and the friend who referred you and start enjoying your Orange Everyday and Savings Maximiser accounts - complete the below steps by

Open an Orange Everyday

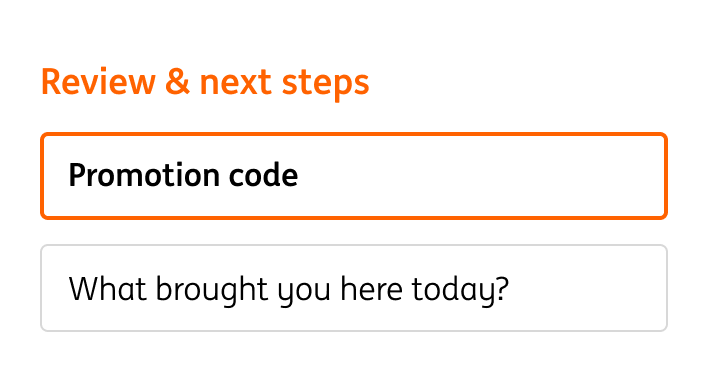

Open an Orange Everyday at ing.com.au/everyday and enter referral code: Ask your friend in the promotion box at the end of the online application form.

Your referral code:

Ask your friend

Deposit $1,000

Deposit $1,000+ from an external source into your new Orange Everyday account within a calendar month.

Make 5+ settled (not pending) purchases

Make 5+ settled (not pending) purchases using your new Orange Everyday card within any calendar month.

Open a Savings Maximiser

Open a Savings Maximiser (if you don't have one already) and activate it by depositing any amount into it.

Payday's not too far away

Once all steps are completed, we'll pop that bonus into your Orange Everyday account and into the account the friend who referred you to ING. This could take up to 30 days after you have met all the requirements and in some cases this may take longer.

Put your savings in beast mode

Once you have an Orange Everyday and Savings Maximiser, you can start earning our additional variable rate whenever you meet the monthly criteria.

p.a.

Variable interest

Includes % p.a. additional variable rate. The standard variable rate is % p.a.

On one account, up to $100,000 when you also hold an Orange Everyday and each month meet the eligibility criteria - see T&Cs for full details.

Big cat's out of the bag.

We're Bank of the Year, 6 years running.

With ING you're onto a beast a of bank (in the nicest possible way, of course).

In fact, we've won Canstar Bank of the Year so many times it's hard to keep count.

Any questions

For more about our everyday and savings accounts, simply visit Orange Everyday and Savings Maximiser.