Less fees, more holiday with Orange Everyday.

Unlimited rebates on ING International Transaction Fees*

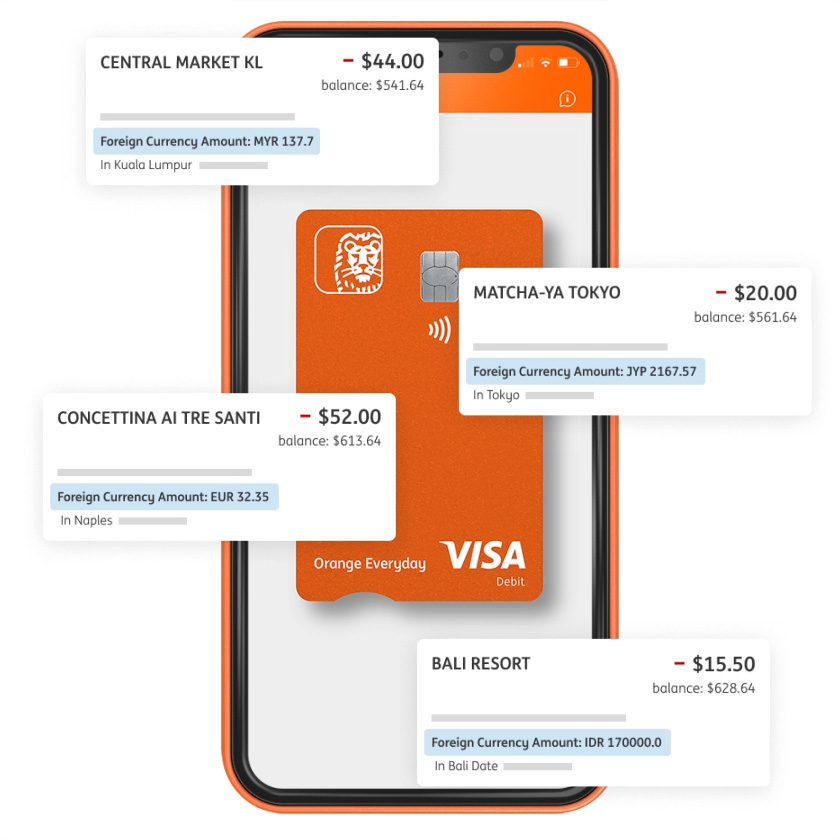

See your spending in AUD & the local currency when purchasing overseas

Exchange rates that will make you smile

Spend like a local

around the world

Forget the currency conversion chore! Simply swipe or tap your debit card, or pay with your phone. The ING App will show you exactly how much you have spent, both in the local currency and Australian dollars when paying overseas.

Get started

International transaction fees can add up… But not with us!

Meet the monthly eligibility criteria* to gain access to unlimited rebates on ING International Transaction Fees for eligible online and overseas purchases. So that you can spend with confidence, knowing you're getting the most out of your travel budget.

Get startedTravel smarter, save smarter

By combining your Orange Everyday and a Savings Maximiser account, you could watch your travel budget grow.

Orange Everyday Benefits

- 1Open an Orange Everyday bank account via the button below.

- 2Deposit $1,000+ from an external source to any personal ING account in your name (excluding Living Super, Orange One) each month.

- 3Use your Orange Everyday to make 5+ settled (not pending) eligible ING card purchases each month - excluding ATM withdrawals, balance enquiries and EFTPOS cash out only transaction.

Savings Maximiser

Grow your nominated Savings Maximiser balance so that there's more in it at the end of the current month (excluding interest) than there was at the end of the previous month.

Why choose ING Orange Everyday?

You're protected

In the rare event of fraud, we're here to help. Your Orange Everyday card also has the added protection of Verified by Visa with participating merchants.

No monthly fees

There are $0 monthly fees, so there's more in your pocket for your holiday. Other fees and charges may apply.

Visa debit card

Spend online or in-store wherever Visa is accepted, plus get access to Visa® travel offers.

1% cashback on eligible utility bills

You could get 1% cashback when you pay any eligible gas, electricity and water bills with your Orange Everyday account by BPAY, PayTo or Direct Debit using your BSB and account number (up to $100 per financial year). T&Cs apply.

Joint bank account

Need a combined household account for bills and your travel? Orange Everyday can also operate as a joint bank account, so that you can simplify your travel budget.

How to access these Orange Everyday benefits

1.

Open an Orange Everyday bank account via the button below.

2.

Deposit $1,000+ from an external source to any personal ING account in your name (excluding Living Super, Orange One) each month.

3.

Use your Orange Everyday to make 5+ settled (not pending) eligible ING card purchases each month - excluding ATM withdrawals, balance enquiries and EFTPOS cash out only transaction.

When the criteria is met in a calendar month, the benefits will apply in the next calendar month.

Open my accountExchange with zero hassle

Enjoy a rate that will leave you with more cash in your pocket to spend on those Aperol Spritz! Simply use your card or withdraw cash from ATMs abroad, as you would at home.

When you meet the monthly eligibility criteria, ING will rebate up to 5 eligible fee incurring ATM withdrawal transactions and unlimited ING International Transaction Fees, whether domestic or international.

International ATM operator fees won't be rebated.

Get a feel for the current exchange rates with the Visa calculator.