Your Orange Everyday benefits.

1% cashback on eligible utility bills

No ING international transaction fees

ING Pocket Perks. Built in Cashback offers. (T&Cs apply)

Hello there!

As an Orange Everyday customer you're onto a good thing - a transaction account bursting with benefits for the taking. Don't miss out.

1% cashback on eligible utility bills

You could get 1% cashback when you pay any eligible gas, electricity and water bills with your Orange Everyday account by BPAY, PayTo or Direct Debit using your BSB and account number (up to $100 per financial year). T&Cs apply.

No ING international transaction fees

ING Pocket Perks

Built in Cashback offers. (T&Cs apply)

Your card at a glance

Your Orange Everyday is a Visa Platinum Debit card. This means it comes with added security, so you can shop more confidently and enjoy peace of mind.

Global Acceptance

Enjoy shopping everywhere Visa and eftpos are accepted, including online, in-store, over the phone and overseas.

Fraud Protection

Visa's Zero Liability Policy* means that you won't be held responsible for unauthorised charges made on your card or account.

Offers and Perks

Access exclusive Visa Offers & Perks like discounts at your favourite stores and restaurants.

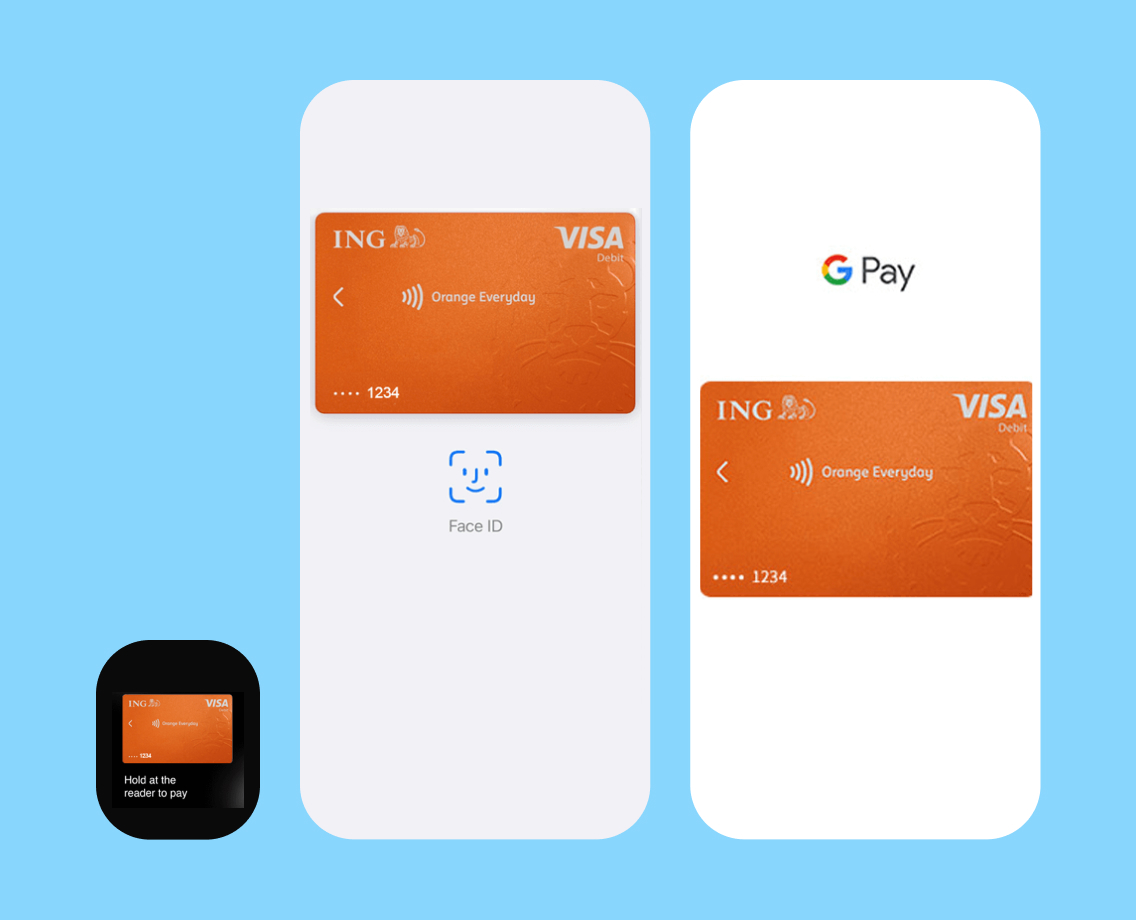

An easier, faster and safer way to pay

Add your Orange Everyday Visa Platinum Debit card to your digital wallet for easy, fast and secure payments on the go.

Easy to set up

All you need is a few minutes - open your Apple or Google Wallet on your phone and add your Orange Everyday Visa Platinum Debit card

Faster to pay

Pay on the go with your compatible phone, tablet or smartwatch anywhere contactless payments are accepted

Secure to use

Your card details aren't stored on your device or shared with merchants so they're extra secure. Plus every transaction is authenticated by your biometric protection or device passcode

Set up your digital wallet today

Set up Apple Pay

Set up Google Pay

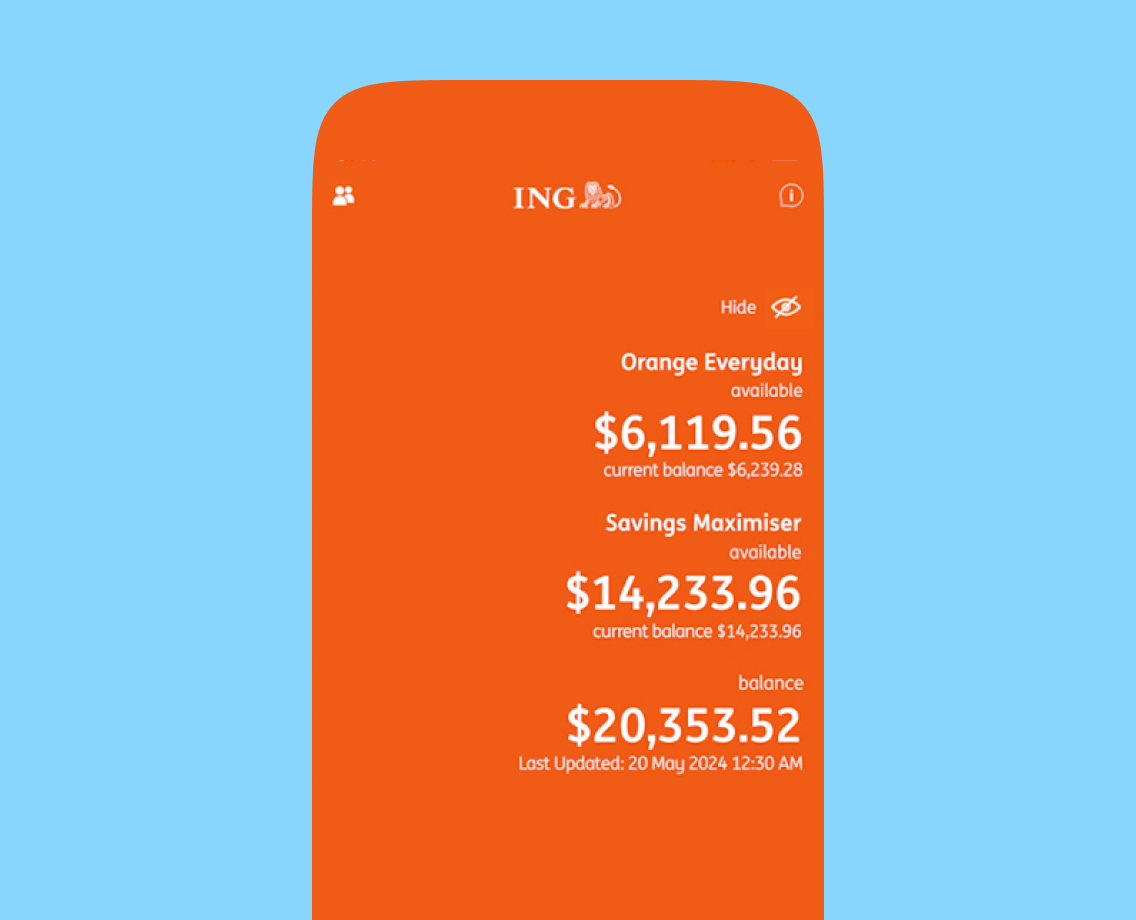

Convenient banking on the go

The ING Mobile app is jam packed with features to help you get things done faster and smarter.

Why Orange Everyday works so well with a Savings Maximiser

Save smarter with our additional variable rate when you:

Then the following calendar month, this rate's yours:

p.a.

Variable interest rate

(inc. % p.a. additional variable rate)

Available on one Savings Maximiser account on balances up to $100,000.

Remember, if you do not satisfy the conditions to receive the additional variable rate, the Savings Maximiser standard variable rate (currently, % p.a.) applies.

Need more help?

Looking for the quickest way to get help with your banking? Check out ING's How-to guides on Help Hub, one central place where you can find answers to the most frequently asked questions. Because less downtime means more uptime for living.